Best Practices + Insights From Ocado's 2018 Annual Report

OCADO IS WIDELY RECOGNIZED AS A WORLDWIDE LEADER IN ONLINE GROCERY. SHOULD COMPETITORS ADOPT ITS STRATEGIES, OR DO SUPERIOR ALTERNATIVES EXIST?

By: Sean Butler and Charles Fallon

AT A GLANCE

- The Online Grocery Market in the US and Worldwide is Set for Massive Growth

- Grocers Must Choose One of Two Online Operational Strategies

- Ultimately, in-store fulfillment is not a sustainable solution. Grocers must develop purpose-built, dedicated online fulfillment centers

- Ocado’s System is Available to Third Parties – Should Grocers Buy it?

Today in North America, Western Europe, China and other key markets, e-commerce leads all retail channels in growth (Forrester, 2018). Still, online grocery sales have long underperformed other digital categories. That is set to change. In the last 12 months, digital grocery has roared to life amidst a rush of investment, research, sales growth and strategic corporate interest.

Ocado Group is the most ambitious of the online grocers worldwide. The 100% online, 100% home- delivery UK company is investing heavily in automation & robotics and has announced agreements to export its services platform to retailers in 5 countries. In 2018, the company posted revenue growth of 11% YoY, reported positive EBITDA and saw its public profile explode. In all, the company’s share price has climbed 120% in just a year.

As its fortunes and profile expand, many executives now look to Ocado’s bold promises of machine-vision, autonomous delivery and life-like robots as the future of the $7 trillion-dollar worldwide grocery industry. However, key questions surround the company, particularly regarding its aggressive use of capital in the face of much lower-cost alternatives and its insistence on using proprietary technologies no matter market conditions. Is Ocado building the grocer of the future while everyone else races to the bottom, or will they outspend the market and fall to the bottom themselves?

Establishing direct-to-consumer delivery capabilities is essential for every grocer, but for many, Ocado’s tactics may result in failure. In this paper, we analyze Ocado’s performance to reveal never-before reported risks to its model, identify best practices available to online grocers in every global market, and explain the fundamentals of success in online grocery.

THE ONLINE GROCERY MARKET

The grocery industry is huge – in 2018, the world’s top 20 markets achieved an estimated $6.7 trillion in sales (IGD, 2018). Today, online grocery trails non-grocery categories in consumer adoption – but that is set to quickly change. By 2023, IGD estimates that ten leading global online grocery markets will experience combined growth at an annual rate of 20%. In some markets this growth will be dramatic – by 2023, IGD predicts the online grocery market will grow by 149% in the US and 286% in China – totalling 3.5% and 11.2% of the total grocery market in each country respectively.

Major changes are underway in the grocery industry worldwide. In the US, Amazon ignited a wave of change in June 2017 by announcing a $13.7 bn acquisition of Whole Foods Market. Shortly after, mass merchandiser Target acquired home-delivery platform Shipt, Kroger and Albertsons spent big to acquire meal kits, and Walmart completed its largest acquisition ever – paying $16 bn to acquire a controlling stake in Indian e-commerce giant Flipkart.

Today, the ten largest grocers in the United States all offer online shopping & home delivery. Some provide these services via self-operated fulfillment centers, while others rely today on Instacart – a pick-from-store third-party platform. In China, Alibaba and JD have accelerated expansion of their respective supermarket of the future concepts, Hema and 7Fresh, blurring the lines between online and in-store grocery experiences.

Globally, grocers are racing to introduce and expand shop-online services, moving away from inefficient third-party partnerships.

Any successful online grocery business has four essential components:

- An efficient, accurate order fulfillment operation

- An efficient last-mile delivery network

- A range of merchandise that matches consumer demands

- An enticing customer experience

FOOD SUPPLY CHAIN COMPLEXITIES

Roman Emperor Augustus recognized how vital and complicated food supply was when in 7 BC he created the position of “Praefectus Annonae” to oversee the complex food distribution system of the Roman Empire. More than 2000 years later, the food supply chain has grown immensely more complex as technology has made vast varieties of food products available to the modern consumer.

Today, the key complexities in food industry supply chains are:

- Temperature controls – Modern diets draw upon a expansive range of foods which have particular storage and distribution requirements:

> Ambient goods, such as dry grains, canned goods and most snacks

> Air-conditioned goods, such as chocolate, candy and some produce

> Chilled goods, where dozens of temperature and humidity conditions must be distinctly managed across meats, dairy, and both wet and dry produce varieties

> Frozen goods, such as frozen berries, par-baked doughs and ice cream - Product variability & perishability

> The vast majority of grocery SKUs consist of highly standardized, industrially produced goods; however, a substantial amount of consumer demand is for product whose quantity and condition depends entirely on nature, such as fresh fruit and vegetables.

> There is wide variability between SKUs which complicates product packaging. Easily-bruised tomatoes, crushable eggs, a loaf of rye bread, a case of bottled water and a bag of flour – this variety illustrates the difficult packaging, transportation, and storage challenges that grocers must address.

> Certain products, such as bread and seafood, have extremely short shelf lives complicating forecasting and inventory management. - Food Safety Controls

> Margins for error in food safety are extremely unforgiving and the consequences of mistakes can be catastrophic. At all points of the food supply chain, there must be strict, comprehensive food safety controls zealously maintained by both public & private sectors.

At the retail level, food supply chains suffer another complication – grocery operations include important manufacturing activities:

- Deli departments slice cold cuts and cheeses

- Butchers cut and trim meat

- Bakers prepare custom cakes for events

- Ready-to-eat / heat-and-eat / ready-to-cook meals are produced

At scale, cutting meat to order becomes a manufacturing process and should be approached as such. Other departments require similar planning

Online grocers must address the full complexities of the food supply chain. Doing so is a daunting task that makes plain why e-commerce began with books and gadgets and not ribeyes and hummus.

CONSUMER EXPECTATIONS

Beyond complex operational considerations, online grocers must solve for high consumer expectations of grocery products. Consumers have high demands of the food they feed their families. Shoppers want to feel the firmness of a pear, inspect the ripeness of a banana and survey the seafood case to see what looks best.

Shelf life and expiry are top of mind when consumers shop for groceries. Shoppers want to pick product with the longest shelf life possible. This expectation must factor into exactly what online grocers ship to customers.

Temkin’s annual survey of consumers in the United States reveals that shoppers overwhelming enjoy grocery shopping compared to banking, fast-food visits, general merchandise shopping, and all other consumer industries (Temkin Group, 2018). In order to maintain the high-levels of trust invested in their consumer relationships, grocers’ online operations must outperform all other industries to win customers.

Online grocers must grow existing consumer trust by consistently delivering high quality products to consumer homes within scheduled delivery windows.

TWO APPROACHES TO ONLINE GROCERY

To date, grocers have executed one of two basic strategies to enable online grocery operations:

- Fulfill online orders from stores

- Fulfill online orders from dedicated, purpose-built fulfillment centers

PICK-FROM-STORE FULFILLMENT OF ONLINE ORDERS

Pick-from-store fulfillment is easy to describe: products flow to store shelves via their normal retail supply chain, consumers place orders for the products available at their local store, pickers walk store aisles and collect these orders, and full customer orders are packaged and delivered to a consumer’s doorstep.

Pick-from-store fulfillment comes in a variety of flavors, which are often confused as separate strategies.

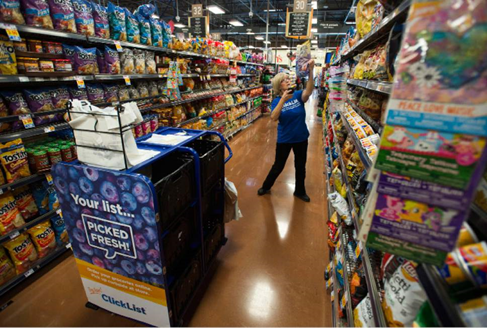

For example, 3rd party partners, like Instacart or Shipt, may walk grocery aisles in lieu of grocery employees. Stores which were previously open to shoppers can be closed and transformed into mini e-commerce warehouses, or “dark stores.” In each case, incremental benefits may exist versus alternative strategies, but a fundamental pick-from-store supply chain remains.

Most grocers have established their initial online capabilities using pick-from-store, and the majority of online grocery transactions in the United States continue to rely on this strategy. And for good reason: fulfilling online orders from stores is the easiest way to serve the demand of existing consumers for online commerce. Grocers need only to implement a front-facing technology platform to accept and process online orders with little additional infrastructure investment required.

However, with order volume, in-store fulfillment strategies quickly fail. With even moderate demand, the negatives of in-store-fulfillment outweigh the benefits of its simplicity:

- The per-order cost of in-store-fulfilment is very high. Store planograms are designed to nurture a customer journey for maximum basket size and optimal shopping experience. Planograms are not designed for picking efficiency. As a result, the “pick travel” to fulfill an online order in-store is substantially longer than alternatives. Labor and other per-order costs are correspondingly high.

> Moreover, grocers today invest stocking labor in stores to create attractive displays of merchandise across departments. This labor is indiscriminately applied to units which will be later picked for online orders, adding further unnecessary costs to the online order.

- In-store pickers compete with customers for access to goods. With order growth, pickers begin to disrupt customers in shopping aisles, negatively affecting the in-store shopping experience.

- Store planograms are not designed to support volumes of online and in-store demand. Sharing inventory across both channels within a store means either shrinking store SKU assortment to accommodate the additional online inventory requirement, excessive store stocking labor and/or diminishing the quality of merchandising.

- Stores must be built in areas of high consumer traffic and/or access. Real estate and construction costs are significantly higher for such locations, compared to industrial locations available to centralized fulfillment centers.

> In-store, aisles and shelves are designed for customer appeal, reducing warehousing density and requiring greater square footage to serve equal volume.

- In-store fulfillment increases the risk of delivering products of unacceptable quality to customers. Centralized fulfillment models allow for detailed quality-verification processes and highly-trained order pickers. In-store fulfillment diffuses responsibility among a decentralized system, and ensuring compliance with quality standards across dozens, hundreds, or thousands of stores is extremely difficult.

> Many grocers today rely on third-party partners like Instacart for in-store picking. These partnerships serve to mitigate the risks of costly fulfillment and capital expenditures. However, partnership strategies pose additional risks to consumer experience. Grocers, already disadvantaged by decentralization, lose further control over training and standards for picking, delivery, and customer service.

Even limited volumes of pick-from-store fulfillment quickly create major disruptions for shoppers

DEDICATED FULFILLMENT CENTERS

Ultimately, any sustainably successful online grocery channel must have a dedicated, purpose-built fulfillment center. Only in such a facility can grocers leverage the cost benefits enabled by e-commerce, including eliminating the expenses of store operations. The balance of this paper will explore how grocers can deploy best practices for dedicated online grocery fulfillment centers.

Globally, there are examples of pure-play online grocers whose fulfillment infrastructure consists solely of dedicated, purpose-built fulfillment centers. Three examples stand out: RedMart of Singapore, FreshDirect of New York City and the United Kingdom’s Ocado.

ONLINE GROCERY FULFILLMENT OPERATIONS

BASIC PRINCIPLES OF ONLINE FULFILLMENT CENTERS

Grocers who operate their own distribution today already have deep knowledge of high-volume food distribution centers. There are two basic kinds of grocery distribution center (DC):

- Food DCs where the base picking unit of measure is the master case

- General Merchandise / Health-Beauty Care (GM/HBC) DCs where the base picking unit of measure is the retail each

Online fulfillment centers share some similar characteristics to these traditional operations:

- In all cases, the basic functions of a distribution center apply:

> Purchase orders from suppliers land on the dock for receiving

> Once received, goods move to storage

> From storage, goods are replenished into pick slots along a pick line

> Order pickers select or “pick” goods on the pick line to fill orders

> Orders are loaded onto outbound trucks for delivery - Like a retailer’s food DC, an online fulfillment center has 3-10 temperature zones from which product is picked, broken into three main picking departments: dry, cooler and frozen.

- Like the retailer’s GM/HBC DC, online fulfillment centers use the retail unit as the base picking unit of measure.

Online fulfillment centers also have unique features resulting from the particular order characteristics of online grocery:

- A typical order will consist of 20-40 order lines from a total variety of 10,000-50,000 SKUs

- Many order lines require significantly more labor to complete than a “straight pick”

> Customers order a quantity of lemons and expect them to be grouped and bagged

> Many products are sold by weight. The specific weight of the order line must be captured for accurate invoicing

> Many order lines will require “made-to-order” processes that involve value added services such as deli slicing

This adds a unique feature on the pick line such that these order lines cannot be picked from a traditional SKU-specific pick slot; rather they must be picked from an order-line-specific pick slot - A wide variety of packaging and product fragility complicates order assembly

> Outside of the protective master case, many products, such as eggs and bread, must be carefully introduced into the order assembly process - Regardless of the delivery method, online fulfillment centers require greater packing functionality versus traditional distribution centers

Given these features of online grocery fulfillment, a dedicated fulfillment center should have four goals:

- Achieve the lowest total cost to ship each order

- Achieve the highest possible throughput, or capacity, given the size of the warehouse and the total number of unique goods, or SKUs, being warehoused

- Achieve the highest level of order accuracy, meaning that the exact number of each SKU demanded by each order should be shipped – nothing more, nothing less

- Achieve the first three goals within a 100% compliant, food safe operation

Like a star athlete, an outstanding fulfillment center combines a world-class brain and body to achieve success.

- The brain of the fulfillment center is its Warehouse Management System (WMS): a software platform that directs all activity and inventory within the four walls of the fulfillment center

> Profitable fulfillment of online grocery requires sophisticated tasking within the fulfillment center. This cannot be done without a powerful WMS which must convert thousands of hourly transactions into efficient work assignments using carefully-engineered rules. - The body of the fulfillment center is its Materials Handling System (MHS): the equipment and labor resources combined to move product from inbound receipts through outbound trucks.

> MHS can range from low-investment systems such as pick carts and shelf-picking to highly automated-picking systems such as Ocado’s OPS or Amazon’s Kiva. These MHS alternatives present different cost outcomes, risks and constraints.

Ocado argues that a capital intensive, highly-automated solution based on self-developed technology is the checkmate to all competitor efforts. But do better options exist?

IS OCADO THE FUTURE OF ONLINE GROCERY?

WHAT IS OCADO?

Ocado has slowly built its profile over 17 years. In 2001, the company first opened its online grocery store, now called Ocado Retail, nine years before Walmart first tested online grocery. In the time since, Ocado has grown to 14,000 employees, 4 fulfillment centers, and $2bn in revenue.

Today, Ocado Retail offers nearly 55,000 products to 74% of households in the UK where the company controls 14% of the highly-competitive online grocery market.

Ocado’s strategy is aggressively premised on the construction of centralized fulfillment centers, and the relentless pursuit of automation and robotization of these facilities.

To serve its retail business, the company operates four “Customer Fulfillment Centers” (CFCs), in the UK cities of Hatfield, Dordon, Andover and Erith.

At each CFC, Ocado deploys a range of self-developed technologies from a home-grown WMS to self-built autonomous robots. It brands this ever-evolving bundle of hardware and software as the “Ocado Smart Platform” (OSP), which the company describes as “a cloud-based bundle of software modules and fulfillment hardware – essentially everything necessary to build an online grocery operation.”

The OSP suite of tools is used not only to run Ocado’s own retail business – Ocado resells the OSP platform to grocers around the world, allowing them a single source for design, implementation and support of online grocery operations.

Ocado is thus composed of two business units:

- Ocado Retail, the 100% online 100% home-delivery grocer

- Ocado Solutions, the business unit responsible for selling Ocado partnerships to grocers worldwide

OCADO RETAIL

2018 was an important year for Ocado’s retail business. The company successfully opened its newest CFC, Erith, the largest robotic picking facility for grocery anywhere in the world. Erith achieved its capacity of 200,000 orders per week less than a month after its go-live. Ocado claims the new CFC is four times the size of the nearest UK competitor’s largest automated facility and expects it will achieve 16x the volume of that facility.

Ocado’s FY2018 annual report shares encouraging results for the company’s retail business:

- Customer numbers grew by 11% in 2018

- Ocado now boasts 721,000 customers

- The company reports 296,000 average orders per week

- Total sales are up 12% YoY

The company proudly declares that it has “dispelled the myths” surrounding online grocery, boasting:

- Ocado Retail is profitable with a 5.6% positive EBITDA.

- Half of Ocado Retail sales are fresh goods.

- The company wastes just 0.8% of goods, as a percentage of total sales

- Total labor to fulfill an order, including inbound delivery to CFC, but not delivery to customer, is 14 minutes.

> Ocado believes this saves up to one hour of labor when compared to store-based fulfillment. - 99% order accuracy

- $139 average order size

Ocado Retail is growing. It is profitable and it is investing in its consumer value proposition, expanding the range of products it warehouses while adding new features:

- Recently enabled integration with voice-activated platforms like Amazon Alexa

- Testing Ocado Zoom, a one-hour delivery service in London powered by third-party Stuart

- Implemented a program to add more emerging brands to its catalogue

- Plans to grow its own-brand ranges

- Customers choose 1-hour delivery windows, and 95% of deliveries are on-time or early

In March 2019, Ocado detailed a new joint venture with multinational retailer Marks & Spencer (M&S). The deal injects about $1bn into Ocado in exchange for a 50% share of the company’s retail business. As important, the agreement allows Ocado access to M&S’s full range of own-brand offerings at cost. This solves a crucial problem for Ocado – an existing sourcing agreement with M&S competitor Waitrose is set for 2020 expiration. Waitrose had resisted further alliance with Ocado, instead choosing to operate its own direct-to-consumer infrastructure.

The Marks & Spencer agreement marks an important validation for the Ocado Retail model. The company is fully joined with one of the UK’s prestigious legacy retailers. However, the agreement also marks an important shift for Ocado as its focus morphs from retail to technology. The company plans to use the full proceeds of the M&S transaction to fund the development of CFCs for its Solutions partners.

What is the value of Ocado’s technology? What are Solutions partners in for? What can we discover by examining its fulfillment centers?

OCADO’S FULFILLMENT CENTERS

In practice, Ocado reveals little about its operations. The press has never been invited to explore an Ocado warehouse without strict conditions, and the company has taken careful pains to keep primary parts of its fulfillment infrastructure from the public eye. Instead, Ocado feeds industry and public interest by releasing slick computer animations and tightly managed videos revealing the periphery of the company’s operations.

These robots are at the heart of Ocado Solution’s marketing efforts.

They convey inventory through the company’s fulfillment centers.

In addition to peeks into its fulfillment centers, Ocado cleverly releases unrelated clips of research efforts ranging from tests of partially-autonomous delivery vehicles to photos of machine-vision equipment and robotic human hands. The sum of these marketing efforts is intended to leave viewers with a very clear message: Ocado is a pioneering technology company, constantly innovating, constantly becoming more efficient.

While robotic picking is not an innovation, picking a wide variety of product types at speeds approximating a human would be an impressive feat. Even then, the greater hurdle would be designing a system able to recognize that an apple is too bruised to pick.

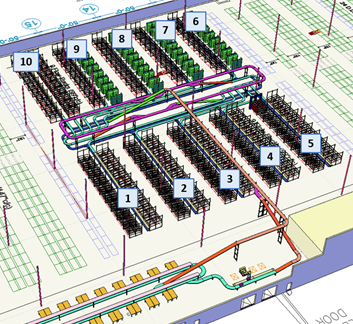

We are sure of certain operating strategies of Ocado’s fulfillment centers:

- Ocado has developed its own WMS to direct inventory throughout its facilities

- Ocado deploys a mix of materials handling systems including:

> Very-narrow-aisle reserve racking with manned turret trucks

> Conveyor systems to shuttle order totes to various departments for fulfillment

> Goods-to-person picking stations

> A proprietary robot storage and retrieval system which operates using similar bot technology principles pioneered by Kiva (now Amazon Robotics)

> There is no robotic picking and packing of customer orders - Each new facility deploys greater proprietary automation than the last

- 4 Central Fulfillment Centers (CFCs) feed into 16 “spokes,” or cross-dock depots where large truckloads of customers orders are transferred onto smaller vehicles for last-mile delivery.

Ocado markets its hardware and software as the “Ocado Smart Platform” (OSP). Operationally, the results are solid:

- For 2018, Ocado reports total throughput of 164 units per hour across the facilities

By comparison, an extremely low-capital operation can only reach total throughput productivity of approximately 100 units per hour. Such an operation would employ simple carts and shelves, with no further automation. If we assigned an average fully-loaded wage rate of $25 per hour to these two models, then Ocado’s fulfillment cost per unit would be $0.15 versus $0.25 for the most basic conventional system – a 40% reduction in fulfillment costs.

A 40% improvement is very significant – but at what cost?

In its published case study of the Dordon CFC, Ocado reports that total capital costs for the project were $301 million, of which only $105 million were “land and buildings.” Ocado spent the balance, $196 million, on “mechanical material handling equipment (cranes, conveyors and storage racking) and technology investment.”

A simple, low-capital “cart and shelf” picking operation

A cart & shelf system for an equivalently sized building could, in an extremely expensive scenario, require a $10 million investment. The net increase in capital investment for the Dordon FC is $186 million. Do the savings justify the investment?

- Dordon’s rated capacity is 180,000 orders per week

- Assuming 25 units per order, Dordon’s capacity is 4.5 million unit picks per week

- The $0.1 per unit differential would generate savings of $450,000 weekly or $23.4 million annually

- The payback period on this investment is 8 years

As a payback period, 8 years is reasonable for investments in assets with long useable lives. So on its face, this may tempt some to strike a “long-view pose” to justify Ocado’s investment. However, there are two key points to consider:

- Equipment depreciates over 7-10 years because that is the useful life of the equipment. An 8-year payback scenario disregards the significant investment required to maintain, upgrade and expand this proprietary and immature platform over its life. This will be inevitable and will push payback well beyond an 8-year horizon.

- This payback calculation compares the Ocado Smart Platform to the most basic, labor intensive option possible (i.e., carts and shelves). Much more capable systems exist at reasonable cost.

In summary: Deploying greater sophistication in materials handling systems can create productivity outcomes that rival Ocado with much lower capital investment.

Building a model to justify the capital expenditure required to implement Ocado’s system requires very high labor costs. In extreme situations, for grocers with labor costs much higher than those used in our calculations, the Ocado Smart Platform could present an attractive option.

Smart investments in appropriate mechanization & automation can

generate attractive returns on investment and compelling productivity outcomes

OCADO SOLUTIONS

Ocado is no longer a pure-play online retailer. Since May 2013, the company has marketed its Ocado Smart Platform to grocers worldwide, offering to deploy OSP to power third-party operations. Today, two Solutions-CFCs are operational. However, in 2018 alone, Ocado completed agreements to add an additional 22 CFCs across 3 customers and two continents. Solutions is poised to develop into the company’s primary source of revenue by 2022. Ocado even muses over the possibility of extending its platform to other areas of online distribution such as general merchandise.

Ocado struck its first Solutions partnership in 2013 with UK grocer Morrisons. With Morrisons, it operates 2 CFCs.

- Recently, Morrison’s limited new deployments of Ocado’s Smart Platform to in-store picking, perhaps signaling a diminished desire to make large capital investments in the complete platform.

In 2017, Ocado signed up another set of European partners:

- In June 2017, Spain’s Bon Preu agreed to implement in-store picking using Ocado technology

> This agreement does not include a CFC - In November 2017, France’s Groupe Casino and Ocado came to terms on planned CFC for the Paris metropolitan area

In 2018, Ocado entered North America and added a Swedish partner:

- In January 2018, Canada’s Sobeys committed to a CFC in Toronto

- In May 2018 Sweden’s ICA committed to a Stockholm CFC and Ocado signed a second blockbuster deal with USA’s Kroger for up to 20 CFCs and exclusive rights to Ocado’s technology in the United States.

Each CFC is expected to go-live two years from its order placement and is likely to have varying levels of automation. Ocado collects signing fees, long-term capacity fees and preparation fees as it adapts its platform to each partner’s needs.

Solutions contracts have no defined period – but without Ocado and its hardware, software, and licenses – partners will have no way to operate these essential facilities.

In the short-term, Ocado has committed to building more than 20 CFCs over the next three years. This incredible pace means enormous risks for both the company and its customers who must now wait for delivery of these turn-key operations. Ocado and its auditors consistently highlight the risk of execution failure.

In the long term, the risks for Ocado’s customers are more significant:

- They become captive with no alternatives or competition when seeking system upgrades or modifications

> This is particularly dangerous given the enormous sums Ocado spends on technology development. That cost burden will be passed onto customers who will have no good recourse. In 2018, Ocado’s HQ costs were up 18.2% YoY primarily due to tech headcount growth. The company has grown its tech salary expense aggressively, expanding from 750 such employees in 2015 to over 1300 today. Over 300 software engineers were added in FY2018 alone. - Expansions to initial infrastructure will always require significant capital investments

- Superior technology from alternative vendors may supersede Ocado’s Smart Solutions. Existing Ocado customers will be too cost-bound to OSP to migrate.

> Ocado’s auditors cast doubts on the prudence of its high capital costs, identifying capitalized project costs as a “key audit matter” due to the significant amounts investment and the high levels of judgement involved. They too were focused on the risk of tech being superseded. “New tech could supersede previously capitalized projects or inappropriate amortization rates could be used.”

> Company management says that the risk of technical innovation superseding Ocado’s own has increased because the rate of innovation of MHE, robotics, and tech solutions in the online grocery market is increasing, creating a competitive market for the Ocado Solutions offer.

Ocado continues to aggressively market the OSP platform and reports that it “expects to do more deals in the medium term in a number of regions.” The most obvious of these deals is Majid Al Futtaim, a rapidly-growing UAE-based retailer that shares Ocado’s chairman of the board, Lord Rose.

HOW TO SOLVE FOR ONLINE GROCERY

When the shock and awe of Ocado’s marketing subsides, grocers should understand that the Ocado Smart Platform is an impressive achievement but not a significant advantage to any of its partners.

Highly competitive alternative solutions at many sizes and investment levels exist to all large and mid-sized competitors. Better still, this can be done incrementally and across a wide supplier base freeing companies from the constraints of a single-sourced solution.

The two basic components of an online grocery operation are WMS and the materials handling system. Between these two components, WMS is far more important. To be successful, each retailer must design and operate a fulfillment center based on their brand’s characteristics – its labor rates, assortment profiles, customer density and so on. Location, level of automation and layout should all be tailored in response, but above all, success in online grocery requires a high-performance WMS.

WMS FOR ONLINE GROCERY OPERATIONS

Picture an online grocery operation that aims to ship 1,000 orders per hour:

- Every hour, the company must load 40-50 delivery trucks

> Completed orders must arrive, 20-25 grouped for specific routes, at the right loading dock at the right time - 1,000 orders per hour must be packed, verified, invoiced and paired with any marketing or promotional collateral as necessary

- 1,000-2,000 order lines will require some form of material processing whether that’s cutting steaks, slicing cheese or assembling a meal kit

- 20,000-30,000 items must be picked, some weighed and labelled, some bagged or placed into fragility crates

- 300-1,000 replenishments of pick slots will occur

- 200 items will be received and put away into storage

In all, every hour, the operation executes approximately 32,000 tasks to ship 1,000 orders. To do so efficiently and flawlessly, the online grocer needs a high-performance brain, or WMS, that applies intelligent rules to blend inventory, workers and those 32,000 tasks into optimal work assignments.

Key features of a high-performance WMS are:

- Food safety controls and product traceability

> Support all necessary food safety programs with quality assurance, testing and controls throughout each product’s journey from receiving to shipping - Manufacturing execution

> Direct and control the inventory transformation of raw materials into finished goods for both made-to-stock or made-to-order processes - Strategic put away

> Direct overstock inventory to readily accessible storage locations while maintaining a food safe environment (e.g., controlling for allergen and organics separation) - Prioritized, coordinated replenishment

> Maintaining inventory in pick-locations without disrupting order picking activity – often the least appreciated and most under-invested feature within a WMS - Efficient picking operations

> Powerful grouping algorithms that leverage order patterns within a wave of orders to create the shortest-routes through the picking system

> Moreover, intelligent ways of matching inventory to orders such as parallel picking and work cell assembly become necessary to eliminate bottlenecks in the operation - Production monitoring

> Clear and comprehensive management reporting on production status and individual performance throughout the operation

The impact of operation-specific grouping algorithms cannot be understated. Incremental improvements can yield major dollar savings. There is no best WMS to buy. There are no best algorithms to implement. Operators must hire engineers to intimately study operations, and design intelligent logic in response. Ocado itself reports significant gains from such investment. For example, the company reports improved deliveries per van in 2018 vs 2017 (194 vs 182), a result they attribute to “algorithm improvements.”

One hurdle many traditional grocers face is that they operate a WMS that serves them very well in their case-based food DCs but cannot accommodate the additional challenges presented by an online grocery, particularly in the food processing and order-picking functions.

MATERIALS HANDLING SYSTEMS

In our previous discussion of Ocado’s fulfillment centers, we set the Ocado system against a simple shelf & cart picking system – the lowest capital-investment option for online grocery. And, at low levels of volume, a simple cart picking operation would suffice.

However, high volume operations justify the investment in both mechanized materials handling (e.g., pick-to-belt technology) and some limited forms of automation. Grocers must understand, however, that the more heavily automated the system, the less that system is able to accommodate changes in business paradigms.

- Ocado recently launched Zoom a service much like FreshDirect’s FoodKick, which promises a limited SKU assortment available for delivery in less than 2 hours.

> None of Ocado’s Smart Platform has been designed to manage this service and the company will have to resort to manual picking methods to achieve its promise. Automation requires system certainty and abhors flexibility.

The key for online grocers is to match the materials handling system to their operation. In a new and maturing operation, that means keeping the equipment footprint light and investing in core systems that can handle a range of online retail strategies. Some key considerations:

- SKU count by department and across temperature zones

- Profile of order sizes

- Order cycle time

- Peak day and peak hour volume lift

- Inventory sourcing & days of supply

- Delivery methods & routes

- Customer density & geographic range

- Packaging strategy

- Promotions, collateral and other marketing related activities

All of the above factor into developing a solution tailored to a grocer’s specific needs. Such a solution must not be simply a matter of answering these questions for the business today, but understanding what impact changing assumptions and conditions will have on a given materials handling solution.

KEY POINTS

- By Ocado’s own reporting, the case for capital intensive automated materials handling is middling at best.

> Both new and maturing operations should deploy materials handling systems with light equipment footprints to promote flexibility, freeing the business to evolve without the constraints of an overly-prescribed operation. - The global food distribution market is worth $7.3 trillion dollars.

> To remain relevant, all grocers must develop digital, direct-to-consumer capabilities.

> While complex, creating a competitive, compelling online grocery operation can be achieved. - In-store fulfillment is not a sustainable solution.

> Grocers will need to develop purpose-built, dedicated online fulfillment centers. - Every fulfillment center must be sized and designed to its operator’s market. Its level of automation, its location and its layout must be adapted based on the categories of goods warehoused, its volume or throughput, the number of SKUs warehoused and other factors. The same is true of online grocery.

- The most important investment an online grocer can make is in a powerful warehouse management system (WMS).

> This system must use nimble, intelligent algorithms to direct efficient work assignments across the diverse activities of an online fulfillment operation. - All things considered, designing, constructing and operating a successful direct-to-consumer fresh food distribution center is a straight-forward, readily achievable initiative

> Capital costs of facilities and the materials handling systems that support them are manageable, and the costs to pick and pack a single order do not threaten the unit economics model.

NEXT STEPS AS DECISION MAKERS

Executive decision makers at grocers worldwide are in a challenging position. Change is occurring so quickly in their industry that they are compelled to make bold moves. However, it is difficult to select the appropriate partnerships, formats and strategies that will create enduring advantage.

Online capabilities are a requirement. After careful study, we must advice: entering into a turn-key partnership is not advisable except in the rarest of circumstances. Fortunately, online grocery operations that incorporate all best practices can be designed from strategy to go-live in a very reasonable period of time.

Moving quickly today will create a lasting competitive advantage.

- To begin, grocers must conduct detailed studies of their item and transaction data, and of their customers. Such study will illuminate the optimal design of its online grocery operation, and reveal the costs and timelines of launching online grocery operation.

- Grocers must retain industrial engineers to design the operations of their fulfillment centers. These engineers must optimally engineer the layout of the facility and the slotting of its inventory.

- Grocers should engage their industrial real estate team to survey sites. Real estate teams should work hand-in-glove with industrial engineers to ensure the best site is selected.

- Grocers should immediately begin a WMS and materials handling selection process to identify the best platforms and implementation teams for its online grocery operation.

- Grocers should engage an expert to commission its construction, managing everything from permitting to construction, to materials handling equipment installation and software integration.

LIDD is a leader in the strategy, design, and implementation of leading online grocery operations worldwide.

BIOS

Charles Fallon is President of LIDD Consultants Inc., the leading supply chain infrastructure consultants in the food and beverage industry. Over his 20-year career, Charles has led facility and technology initiatives throughout the food supply chain, including a wide variety of food retail operations online and offline.

Sean Butler is Managing Director of the Demand Chain Strategy Practice at LIDD Consultants Inc. A recognized thought-leader in food retail, Sean’s career includes many innovations of the past decade including the first in-store meal kit.